Esatablished in 2008 - Institutional DNA - Proven Track Record

Long term capital commitment

Seeding from parent group.

Institutional infrastructure

Our state of the art technology supports our fundamental analysis and provides effective reporting tools for clients, style analysis and performance attribution.

Fully regulated

Pelargos is regulated under the AIFM directive and reports to various industry oversight bodies. Pelargos is an AIMA member and we have best in class partners; prime brokers Goldman Sachs and UBS, administrator BNY Mellon, accountant PwC.

Risk concious

To compound wealth means understanding risk. But risk is not the same as volatility. Our fundamental research aims at understanding value and risk.

Our people

Our strategic partners

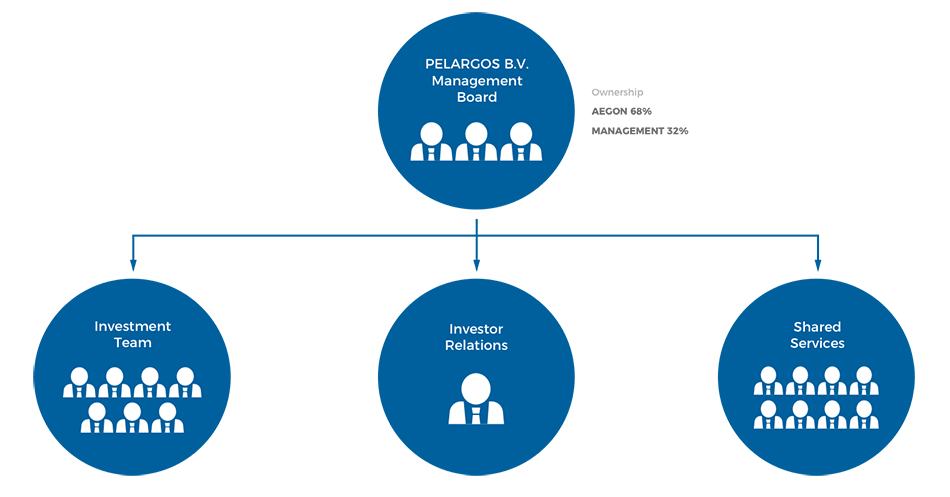

Aegon is majority shareholder and cornerstone investor.

Aegon’s 26,000 employees generate annual revenue of 30bn Euro across 25 countries. Its stock is listed on Euronext and the NYSE and has a market capitalization of 14bn Euro. Aegon is SOX compliant and reports under IFRS.

Pelargos has a local presence in Japan through our research and marketing partner Gordian Capital Japan.

Gordian Capital houses our Japan-based research analyst who provides corporate access and detailed fact finding for our in-depth research.

Company profile

-

A Schematic Overview

-

-

Key Service Providers

-

Pelargos works together with these best in class service providers:

- Audit – PwC

- Fund Administration – BNY Mellon

- Prime Brokers – Goldman Sachs, UBS

- Registrar – BNY Mellon

- Transfer Agency – BNY Mellon

-

Information

-

Legal

Pelargos Capital B.V. is a private company with limited liability (besloten vennootschap met beperkte aansprakelijkheid, BV). Pelargos was incorporated on March 4, 2008 in The Hague, The Netherlands, and is enlisted with the Chamber of Commerce in The Hague under the reference number 27308299.

Pelargos obtained the license to manage investment funds (as meant in Article 2:65, first paragraph, sub a, Wet Financieel Toezicht) by The Netherlands Authority of the Financial Markets (Autoriteit Financiële Markten (AFM)) as of December 9 2010. On July 22 2014 the license migrated to AIFMD registration with number 15000912.

Per 1 March 2017 the AIFMD license has been extended with the following investment services provided to professional investors only: (i) Individual portfolio management, (ii) Investment advice and (iii) receiving and transmitting investment orders.

Download the register of the AFM.

Regulation

Registration

Extract Trade Register Pelargos Capital

Extract Trade Register Depositary

Policies

Pelargos Conflicts Of Interest Policy

(Semi) annual report

Semi Annual Financial Figures Pelargos Capital BV 2021

Annual Financial Figures Pelargos Capital BV 2020

Semi Annual Financial Figures Pelargos Capital BV 2020

Annual Financial Figures Pelargos Capital BV 2019

Semi Annual Financial Figures Pelargos Capital BV 2019

Annual Financial Figures Pelargos Capital BV 2018

Semi Annual Financial Figures Pelargos Capital BV 2018

Annual Financial Figures Pelargos Capital BV 2017

Semi Annual Financial Figures Pelargos Capital BV 2017

Annual Financial Figures Pelargos Capital BV 2016

Semi Annual Financial Figures Pelargos Capital BV 2016

-

Japan Stewardship Code