Great opportunities in Japan

The Japanese market is inefficient. A paradise for fundamentally driven value investors.

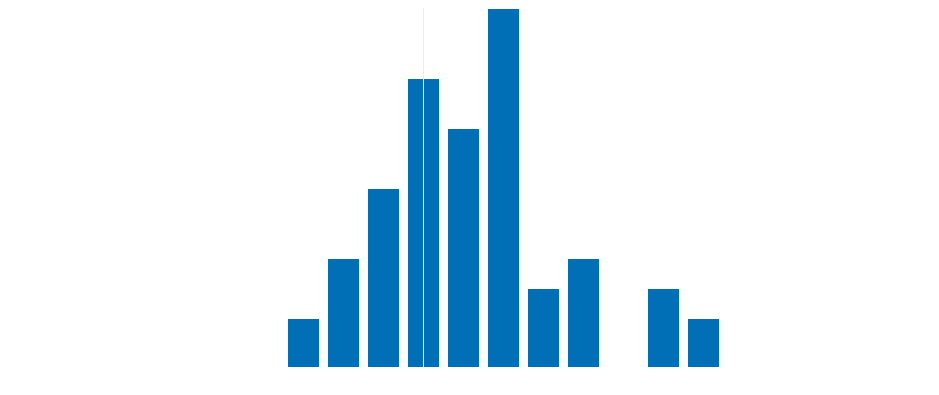

HIGHLY INEFFICIENT MARKET MEANS HIGHLY SKEWED PAY OFF STRUCTURES

WHY IS THE JAPANESE MARKET SO INEFFICIENT?

Trending behavior

Overemphasizing macro economic trends and top-down themes, the investment community tends to extrapolate forecasts causing dislocation.

Negative investor perception

Investors perceive Japan as having poor disclosure, weak corporate governance and a hostile stance towards equity investors.

Looking in the wrong direction

Fund managers and analysts alike overemphasize earnings growth and disregard balance sheet analysis where true value can be found.

Short-Termism

Long term investing is an unpopular concept, many market participants are short term momentum followers who ignore valuation.

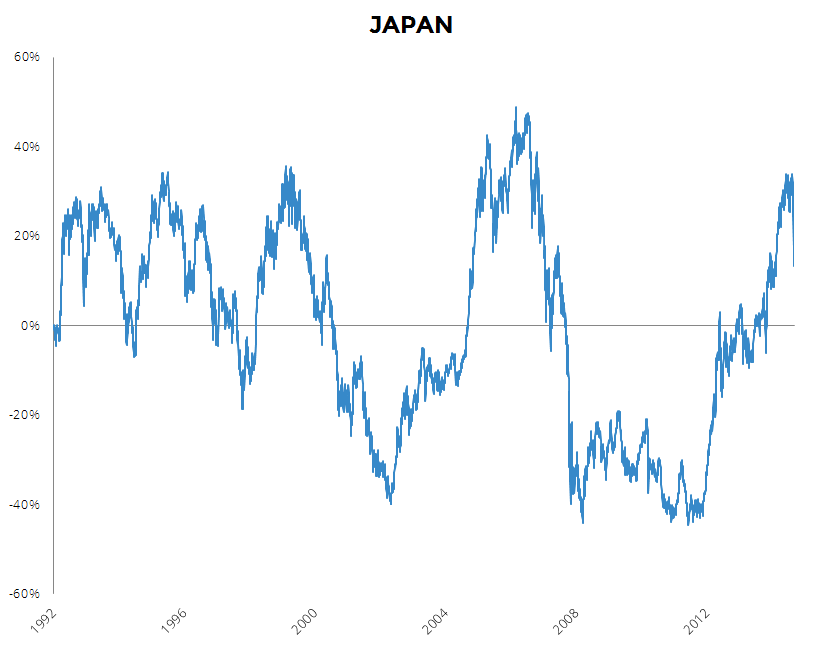

But Japanese equities are highly volatile

Volatility is not risk, permanent loss of capital is.

That is why we control the downside

We select for the upside and manage the downside.

We select for upside as fundamental value stock pickers. We control the downside by continuous risk control at both single stock and portfolio level. This combination leads to stable, uncorrelated returns with low volatility.

Our value approach

Systematic idea generation. Detailed fundamental analysis. Disciplined risk management.

Building our philosophy.

Pelargos Capital was established in 2008 in the midst of the global financial crisis. Two major bear markets in less than a decade had a profound impact on our culture and reinforced our believe that investing is about understanding risk and taking risk when the odds favor us to do so.

Kaizen

Financial market participants operate in a dynamic, interactive and adaptive environment. We strive to continuously improve ourselves and the way we operate. Over the past decade we strengthened our analytical investment framework and stepped up our engagement with companies on the subject of corporate governance improvements. Improving corporate governance will strengthen Japanese corporations and benefits all stakeholders and society.