Performance

Key characteristics

| Strategy description | The Pelargos Japan strategy is a fundamental value equity approach based on systematic idea generation and enhanced by disciplined risk management. We offer a long/short as well as a long only strategy. |

| Strategy classification | Fundamental long-short equities, long only strategy available as well. |

| Fund structures | Dutch Fund for Joint Account (EUR and USD) for Japan long/short strategy, currently in liquidation. |

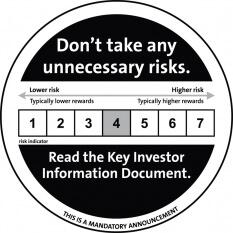

| Risk profile long/short strategy |  |

Sustainable Finance Disclosure Regulation (SFDR)

As part of its investment process, Pelargos Capital includes all relevant financial risks in its investment decision making process and evaluates them on an ongoing basis. In doing so, all relevant sustainability risks within the meaning of Regulation (EU) 2019/2088 of the European Parliament and of the Council of November 27, 2019, on sustainability-related disclosure requirements in the financial services sector (""Disclosure Regulation""), which could have a material negative impact on the return on an investment, are also taken into account.

Sustainability risk means an environmental, social or governance event or condition that, if it occurs, could cause an actual or a potential material negative impact on the value of the investment. Sustainability risks can therefore lead to a significant decline in the financial profile, liquidity, profitability or reputation of the underlying investment. If sustainability risks are not already taken into account in the valuation process of the investments, they can have a material negative impact on the expected / estimated market price and/ or the liquidity of the investment and thus on the return of the fund. Sustainability risks can have a significant impact on all known risk types and, as a factor, can contribute to the materiality of these risk types.

Pelargos Capital's investment strategies do not promote environmental or social characteristics within the meaning of the Disclosure Regulation (Article 8) nor are they classified as sustainable investments (Article 9).

-

Monthly newsletter

-

Official information

-

Fund structure

The Japan long/short equity fund is an open-ended investment fund authorised and registered by the Netherlands Authority for the Financial Markets (AFM).Tax structure

The Fund is a Fund for Joint Account (FGR, “fonds voor gemene rekening”) and qualifies as a Dutch tax exempt entity (VBI, “Vrijgestelde Beleggingsinstellingen”), and as such adheres to the specific accompanying tax requirements.Official documents

Ebi Essentiele Beleggersinformatie (Dutch)

Amendments

Announcement amendment prospectus and terms Pelargos Japan Alpha Fund_English July 2020

Application forms

-

Annual reports

-

Semi Annual Report Pelargos Japan Alpha Fund 2021

Annual Report Pelargos Japan Alpha Fund 2020

Japan Stewardship Code: Pelargos Japan AGM Voting Report 2020

Semi Annual Report Pelargos Japan Alpha Fund 2020

Annual Report Pelargos Japan Alpha Fund 2019

Japan Stewardship Code: Pelargos Japan AGM Voting Report 2019

Semi Annual Report Pelargos Japan Alpha Fund 2019

Japan Stewardship Code: Pelargos Japan AGM Voting Report 2018

Annual Report Pelargos Japan Alpha Fund 2018

Semi Annual Report Pelargos Japan Alpha Fund 2018

Annual Report Pelargos Japan Alpha Fund 2017

Semi Annual Report Pelargos Japan Alpha Fund 2017

Annual Report Pelargos Japan Alpha Fund 2016

Semi Annual Report Pelargos Japan Alpha Fund 2016

Annual Report Pelargos Japan Alpha Fund 2015

Semi Annual Report Pelargos Japan Alpha Fund 2015

Annual Report Pelargos Japan Alpha Fund 2014

Semi Annual Report Pelargos Japan Alpha Fund 2014

Annual Report Pelargos Japan Alpha Fund 2013

Semi Annual Report Pelargos Japan Alpha Fund 2013

Awards & nominations